When Dan Arnold ascends to the CEO role of LPL Financial in January, there are two hurdles he will have to surmount to ensure the firm’s future success.

Arnold, 51, who is currently president and a former CFO, can expect his tenure as chief executive of the nation's largest independent broker-dealer to be dominated by seismic technology shifts and regulatory scrutiny, according to industry experts.

Read more:

LPL is adopting digital advances that are revolutionizing how wealth management services are delivered to clients. In April, LPL said it was contracting BlackRock's FutureAdvisor to develop a digital advice platform.

Though additional details are yet to come, the move is intended to offer clients more sophisticated digital services they expect from wealth management firms.

"Today, consumers, especially millennials, spend more time speaking with an iPhone app than they do with another human being," Lex Sokolin, global director of Fintech Strategy at Autonomous Research, says.

Earlier this year, outgoing CEO Mark Casady, 56, said

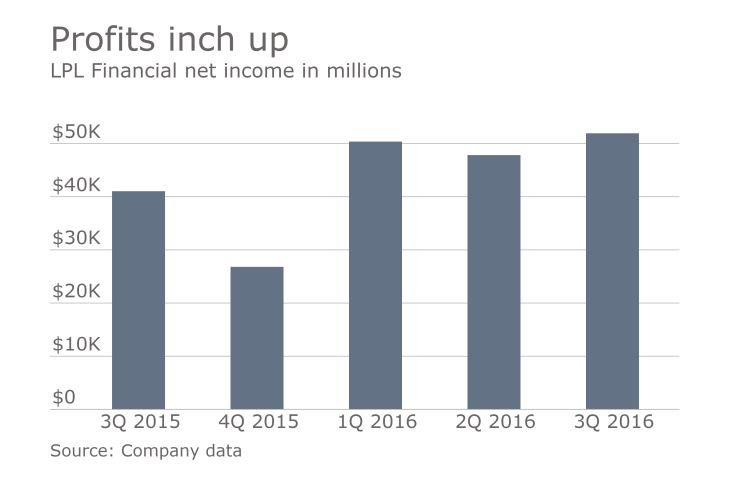

"I feel like we are rounding a new corner here at LPL. We've gotten through the initial investments," Casady said at the firm's annual conference.

While wirehouses are largely opting to develop new technologies in-house, large independent firms are generally contracting for existing technologies in the marketplace, Sokolin says.

"It's both good and bad," Sokolin says. "You can go shopping and find what is the latest and best in customer experience and just buy it rather than build it from scratch. … On the flip side, you don't own it. You're beholden to your service provider," he says.

Using third-party providers to design these new toolspresents another unique problem: They have to integrate seamlessly with legacy technologies in use by advisers and clients.

This is where LPL's scale can prove to be both advantage and disadvantage; it's large enough to have money to spend on new technologies, but its size may prove cumbersome, experts say.

Challenges aside, it’s imperative to digitally innovate in order to stay relevant. Not only will clients want digital offerings and expect superior services, the firm's 14,000 advisers will too.

"You're basically engaged in an arm's race in terms of technology investments," says Uday Singh, a partner in the financial institutions practice of A.T. Kearney, a consulting firm.

REGULATORY HEADACHES

When Arnold replaces outgoing CEO Mark Casady, 56, in January, he'll also be inheriting a huge effort to ready the firm for the Department of Labor's fiduciary rule.

The rule has preoccupied the attention of industry leaders as well as thousands of advisers who want to know how their practices will operate within the new regulatory framework. A key concern has been whether firms will continue to offer commission-based retirement accounts.

The firm said earlier this year that it would standardize commissions and share classes that it pays its brokers. LPL has about $495 billion in brokerage and advisory assets, the company says.

-

The country's largest IBD is said to be exploring strategic alternatives, which may include shopping itself around for buyers.

October 11 -

Industry experts survey the field of potential suitors.

October 12 -

With LPL Financial potentially exploring a sale of itself, we look back at some of the biggest deals over the last few years.

October 11

Some industry observers also anticipate that the new regulation will also crimp revenue growth across the industry, but particularly at independent firms.

"IBDs don't have the same kind of margins that wirehouses and regional firms do. So when you have regulations that jack up their overhead, it's more of a challenge for them," says Mark Elzweig, a recruiter.

And at the same time that the regulation may hurt profits, it's also expected that it will increase technology and compliance costs as firms will need to upgrade systems.

Although President-elect Trump may overturn the Labor Department regulation, it's still currently scheduled to go into effect in April. Even if the rule was repealed, it may not matter in terms of the long-term direction of the industry, says Alois Pirker, research director at Aite Group.

"The drive to a fee-based, the drive for digitization is still going to take place and firms will have to evolve. They'll have to change," Pirker says.