Like a cell undergoing mitosis, the wealth management industry is beginning to divide into information technology haves and have nots. In the past, advisors who were late adopters of technology suffered little, because the vast majority of their peers were in the same boat. But, as the results of Financial Planning’s 2015 tech survey make clear, that is no longer the case.

One striking finding: Reflecting the growing impact of all things digital on their practices, none of the 600 advisors we surveyed cut their IT budgets this year. On the other hand, while 50% of RIAs grew their budget, nearly as many left it unchanged.

Amid this and other findings, we see the outlines of a new class of eadvisors emerging — tech-savvy planners who embrace IT as a competitive differentiator and a key tool with which to grow their business.

This is reflected, for example, in a recent study by Fidelity Investments entitled “eadvisors Take the Lead.”

Fidelity found that, as a group, eadvisors have nearly 40% higher AUM, serve 55% more clients — of which a greater percentage belong to Generations X or Y — and are more satisfied with their careers.

What are the behaviors of these eadvisors? FP’s survey finds that they offer clients a collaborative platform (e.g., a client portal), use data aggregation to provide them with a total picture of their assets, keep in close touch with automated email alerts, track client interactions via CRM software, communicate and promote their practices via social media, automate their workflows, and use online risk and compliance tools. Our data also suggest that this group is disproportionately composed of younger advisors.

And while we don’t conclude that this emerging group is poised to dominate the profession just yet, these advisors appear to be making many of the right moves with regard to technology. And that bodes well for their future.

Given this and our other survey findings detailed below, the question advisors should be asking themselves with regard to technology is: Am I investing sufficient time and dollars to remain competitive?

By the time you finish reading this article, you should have a better understanding as to why you should up your technology game, and what technologies you should focus on. We’ll also show you where and how younger advisors approach technology differently from their older peers, and which technology vendors are more likely to survive and thrive in the coming period.

WHOM WE SURVEYED

Roughly 33% of our survey respondents identified themselves as independent RIAs. Another 39% self-identified as affiliated with a broker-dealer, and 10% indicated they are independent and dually registered (IDR). Just over one out of four (26%) of our survey takers work at firms with AUM in excess of $500 million; 22% are in the $100 million to $499 million range; 13% are in the $50 million to $99 million range; and 13% manage between $25 million and $49 million in assets.

A majority (52%) are compensated by both fees and commissions, while 27% are fee-only and 7.5% are commission-only. The rest either receive a salary or a retainer. Almost 80% of the respondents are male; 70% fall between the ages of 25 and 54.

PLANNING SOFTWARE

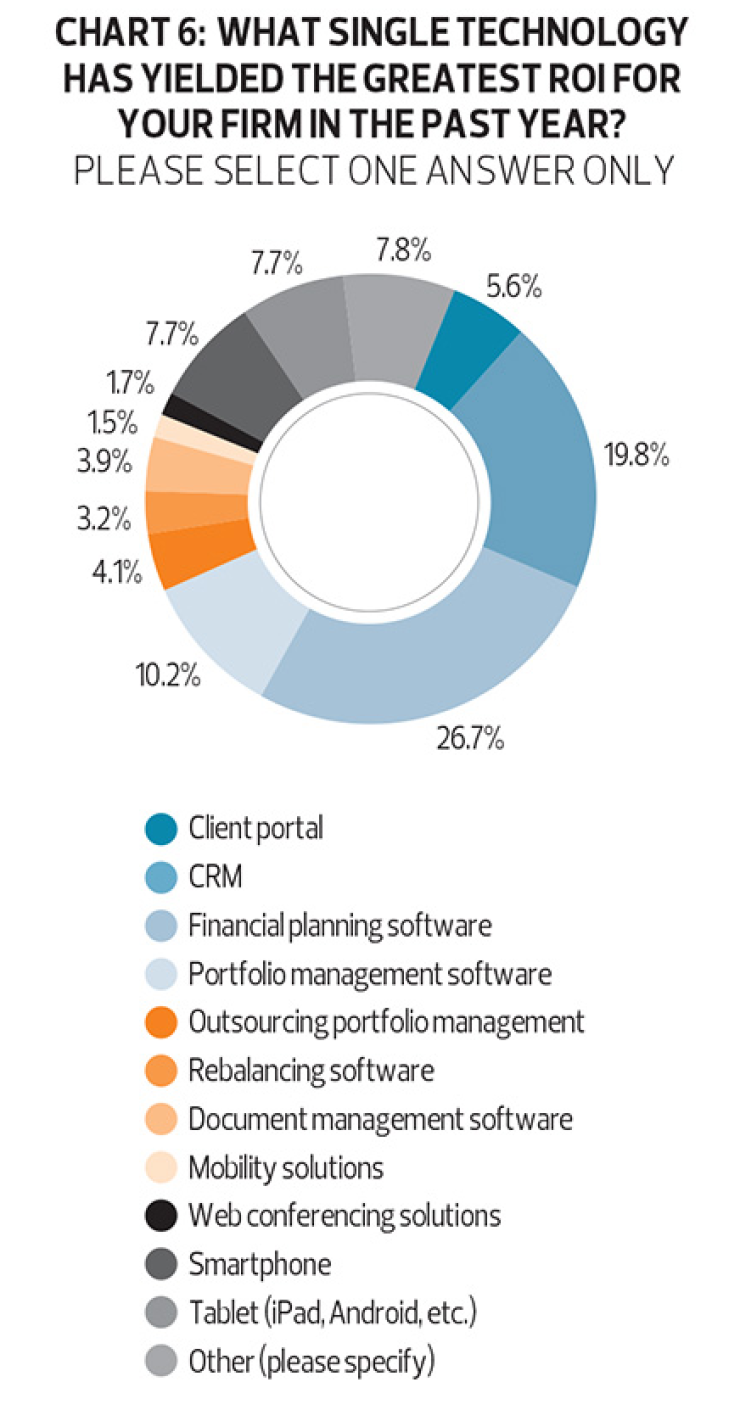

When we asked advisors what single technology had the biggest impact on their business this past year, financial planning software was the number one response, as it was last year. It was also cited as the technology that yielded the greatest ROI.

And the younger the advisor, the bigger the impact: Over 39% of our 25- to 34-year-old survey takers said financial planning software yielded a greater ROI than any other technology, compared with 27% of respondents overall.

This makes sense when you consider that advisors are using the software to automate that portion of their services that has become commoditized, freeing them to focus on areas that add value for their clients and differentiate their offerings.

If financial planning software yields such high returns, one could argue that everyone should be deploying it, but 20% of our respondents are not. Still, the trend toward adoption is in the ascendant. Last year, nearly a fourth of our survey takers (23%) still weren’t using planning software, and in 2013, almost a third (31%) weren’t making use of the software.

Firms with under $25 million in AUM were less likely than average to use financial planning software, while firms with over $25 million in AUM were more likely. If there’s one lesson small firms should take away from this data, it is that they should invest in this application sooner rather than later.

Among the offerings on the market, MoneyGuidePro remains the top choice of readers, as it has been every year since we began conducting this survey in 2008. eMoney remains the runner up, as it has been since 2010.

Our data suggest that these two brands are likely to maintain their category dominance for quite some time. How do we know? Their usage among 25- to 34-year-olds and 35- to 44-year- olds is much higher than their market share overall. Compare this with Money Tree, which has much lower than average usage among 35- to 44-year-olds, but much higher usage among senior advisors ages 65 to 74. For Money Tree, that could spell trouble if the trend continues.

THE ROBOS SETTLE IN

Digital advisor platforms, commonly referred to as B2B robo advisors, are here to stay. The question is no longer will these platforms survive, but rather which one should an advisor choose to work with. Over a third of our respondents (36.8%) are already making use of digital platforms.

We were somewhat surprised to see that, among our readers, Wealth Access was the most popular digital platform, with 14.1% of our respondents making use of it. We’re not knocking Wealth Access; we just were not aware that it was that popular. Schwab Institutional Intelligent Portfolios, the platform we expected to dominate, came in a close second overall with a 12.3% share. Among independent RIAs, however, Schwab dominated with a 22.9% share versus a 5.7% share for Wealth Access.

We are also hearing that many advisory firms would like to offer an advisor-assisted robo-based service in 2016, but two things are slowing them down. The first is that some firms have yet to figure out how to position the offering and whether they should provide it through a separate division. The other hold-up is that some firms are waiting for their broker-dealer or custodian to roll out an offering. For instance, we expect LPL to release a robo service sometime next year.

The bottom line on robos is this: Given their short history, a 37% adoption rate among our respondents is remarkable, and we fully expect that number to trend higher in 2016.

CLIENT PORTALS

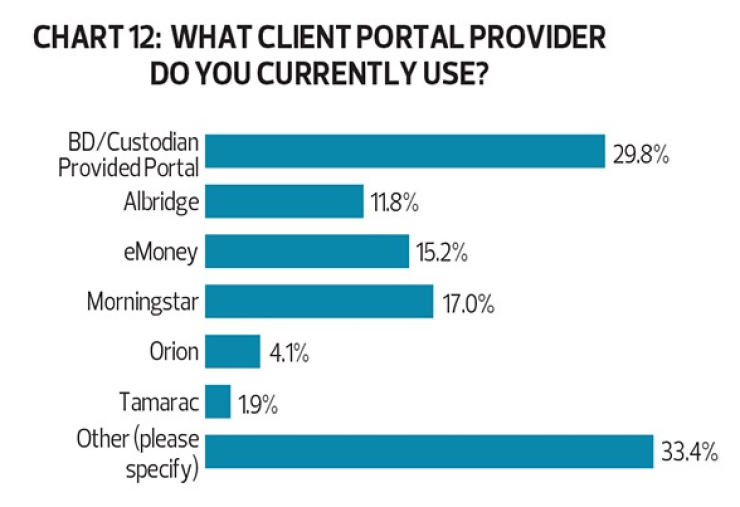

This application has gained in popularity over the past several years, and 76% of our respondents say they now offer a client portal. Overall, the most popular offerings are those provided by a firm’s custodian or broker-dealer, followed by products from Morningstar, eMoney and Albridge.

eMoney appeals to younger advisors, especially those in the 25- to 34-year-old age group. advisors ages 55 and up were significantly less likely than their peers to offer any portal to their clients.

Among RIAs, the custodial client portal is also the most popular, but eMoney only trails by 1.6%. But client portal adoption among the independents trailed the overall group. Almost 36% of independent RIA firms say that they do not offer a client portal. That was a shocker to us.

THE CRM EQUATION

CRM was ranked second, behind financial planning software, as the technology with the biggest business impact and the greatest ROI. The reasons are multi-fold:

A CRM application often serves as an advisory firm’s hub. The software acts as the central repository for all client information, and tracks tasks and assignments made to different advisors. A good CRM program can also automate workflows, which improves speed and efficiency. And if CRM software is properly configured and used appropriately, it can provide useful business intelligence that can further enhance productivity and profitability.

For example, many CRM products for advisors now offer business intelligence dashboards. These display important business metrics such as AUM by advisor, revenue per client, profitability by advisor and by client, the average age of the client base and a good deal more.

Yet over 21% of our respondents say they use Microsoft’s Outlook as their CRM. Since MS Outlook is not true CRM software, the implication is that a substantial group of advisors don’t fully appreciate what a real CRM system can do, and are not reaping the ROI it can provide.

Among our more enlightened respondents, Redtail and Salesforce were the most popular choices. Wealthbox CRM, a relatively new entrant to the market, started to make its presence felt this year. It garnered a 2% share, up from 1.2% last year. But among independent RIA’s, it grabbed a 4.2% share.

Wealthbox also scored very well with firms under $25 million in AUM, as did Redtail. This should come as no surprise, as both vendors offer industry specific products that are priced very aggressively.

THE WORKFLOW

In spite of the overall popularity of CRM software, our survey takers indicate that they need better technology to help them with two challenges in particular: streamlining their workflows and improving their time management. Yet CRM systems are well-known for addressing both of these issues. That leads us to wonder, again, if all of our readers actually fully appreciate what a CRM system is. We can’t cross-reference how many of our respondents who are struggling with operational inefficiencies are using MS Outlook as their CRM, but we suspect there are more than a few.

We’ll also venture a guess that many advisory firms that own a true CRM application still aren’t receiving the full benefit of their software. There are a number of possible reasons for this. They may have purchased the wrong CRM system for their firm, or the software was improperly configured and their advisors were never adequately trained on its use.

A CRM system can either be a general purpose product or industry specific. An advisor who purchases the former has to configure it with all of the fields that apply to a wealth management practice. For both types, the workflows have to be tailored for a particular firm. Some CRM products include standard workflows, but the software’s developer or a third-party integrator will customize it for a fee.

This also might require integrating several different software products, because many workflows extend across multiple applications. For example, an account-opening workflow might entail using the CRM, an auto-form filling application, an eSignature program, a custodial or B/D platform and, possibly, a firm’s portfolio management program and financial planning software.

If a firm’s CRM system can’t be integrated with all of its other systems, the firm will never be able to use all of the CRM’s workflow features. Unfortunately, many advisors aren’t aware of all of these dependencies and don’t take them into account when they select a CRM system.

MANAGEMENT SOFTWARE

The portfolio management and accounting software category remains highly competitive. That’s not surprising, as it is one of the more expensive applications (or services, if the system is cloud-based) that most advisors are liable to purchase.

Overall, the five most popular offerings were the same as last year: Morningstar, Albridge, PortfolioCenter, Envestnet and Orion. A significant 17% of our respondents indicated that they do not use a portfolio management program.

REBALANCING SOFTWARE

Perhaps the most striking thing about the rebalancing software data is the overall rise in usage. As recently as the 2013 survey, 39.4% of respondents said they use rebalancing software. In 2014, that number rose to just over 50%. In 2015, 62.7% of respondents said that they use rebalancing software. That’s an amazing jump in such a short time span.

There are a number of reasons for the rise in the popularity of this software. Risk management is an obvious one. If an advisor creates an asset allocation across a portfolio or household, the object is to match the portfolio to the client’s appetite for risk, as well as to achieve the highest possible return for the given level of risk. If a portfolio drifts away from the target allocation, it is no longer optimized for risk and/or reward.

We think a more likely reason for the rise in popularity of rebalancing software has to do with compliance and regulatory concerns. Increasingly, regulators are looking at what advisors say they will do for clients and comparing it to what they actually do. If an advisor’s documents or correspondence with clients indicates that they will keep the portfolio aligned with targets, they had better do so. Doing so manually, without the aid of rebalancing software, is difficult, time consuming and ultimately inefficient.

Having said that, not all rebalancing software is created equal. How do they differ?

Well, just about all rebalancing software allows you to set up target asset allocations. Usually, you can set bands around those target allocations (e.g., 10%). So, for example, if your allocation to an asset class is 20%, and the allocation goes above 22% of the portfolio or below 18%, you are alerted. Some applications rebalance it only at the account or client level. The better ones allow you to do it at the household level.

Some optimize for taxes and location, others don’t.

Generally speaking, there is a correlation between price and features. The more expensive programs can rebalance at the household level, optimize for location and taxes, and perform other premium tasks.

Our overall leader in the category, Morningstar, historically has not offered tax or location optimization. But with Morningstar’s purchase of TRX, those capabilities are now available, at a somewhat higher price.

As the line between Envestnet and Tamarac, now an Envestnet company, blurs, it is difficult to get a read on what percentage of respondents who answered “Envestnet” are actually using the more sophisticated Tamarac rebalancer.

The current overall leader in sophisticated rebalancing software is iRebal, followed closely by Tamarac.

When we look at the independent RIA space, we get quite a different picture. Here, iRebal actually leads with a 9.9% share, followed by Morningstar with an 8.3% share. Right on their heels is Tamarac, with a 7.8% share.

We broke out iRebal cloud separately for the second year running. This is a free, Web-based version of iRebal available only to TD Ameritrade advisors. Although its overall 1.9% market share is small, among independent RIAs, it commands a 4.2% share.

The conclusion we draw from this data is that a larger percentage of independent RIAs are using sophisticated rebalancing software when compared to their peers. This means one of two things: Either they are delivering tax alpha to their clients while many of their competitors are not, or they are doing this in an automated, cost-efficient fashion, while many of their competitors are not. In either case, we think independents using the sophisticated rebalancing software have a distinct competitive advantage.

When we look at rebalancing software usage by age group, we see that younger advisors seem to appreciate its advantages. 62.7% of our 25- to 34-year-old advisors use it, versus 53.4% of the overall sample.

Once firms surpass the $100 million AUM mark, there is roughly a 60% chance that they will use rebalancing software. Intuitively, this makes sense. As firms grow, manual rebalancing becomes more difficult and time consuming. It is also likely that they will be competing for higher-net-worth clients who can benefit more from the addition of tax alpha. Finally, larger firms have the financial resources to purchase premium rebalancing products.

RISK TOLERANCE

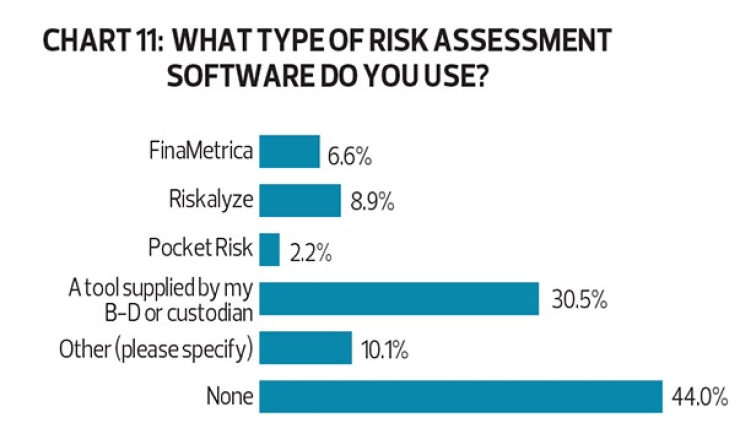

We don’t know whether to be puzzled, disappointed or shocked by the responses to our client-risk-assessment question.

From our perspective, every advisor has a duty and a regulatory responsibility to gauge a client’s risk tolerance before making any investment recommendations, yet only 56% of advisors said that they use this software. Did they not understand the question? Are they still using paper forms? Or are they not performing this basic function at all? We certainly hope it is not the latter.

The leading providers of risk-tolerance software remain the broker-dealers and custodians at 30.5%. Of the third-party software providers in the group, Riskalyze edged out FinaMetrica for the top spot in the category.

The rise of Riskalyze has been impressive. Founded in 2011, and a virtual unknown until two years ago, it now leads the category with an 8.9% market share. As the firm builds its brand and expands its product line, we expect its growth to continue at an impressive pace.

PENNY WISE, POUND FOOLISH?

It appears that many firms are not particularly thoughtful or sophisticated when it comes to their technology purchasing decisions. The majority of advisors, 54.2%, say that cost is how they determine the ROI of their technology purchases.

On a more promising note, 51.4% say that time savings was the determining factor (we allowed for multiple responses on this question). Staff feedback (39.4%) was another popular evaluation method. Only 8.5% do any sort of formal ROI analysis, however. Perhaps more troubling, 32% don’t perform any ROI evaluation at all.

There also seems to be a disconnect between advisors’ technology goals and their technology behavior. When we asked which technology goals were most important, increasing profitability/efficiency was the top choice, followed by enhancing the client experience/satisfaction.

However, without a formal ROI analysis, how do these advisors know whether or not the technology purchases are actually providing the necessary profitability and efficiency boost? It should be clear to anyone with a financial background that cost alone is probably not the best determinant of ROI.

TECHNOLOGY SPENDING

Although firms appear to factor cost heavily into technology purchasing decisions, they seem somewhat more willing to spend than before. Thirty-one percent of advisors say they plan to spend 6% to 10% of their revenue on technology in 2015. Another 31% say they will spend 1% to 5% of revenue. Another 19.3% said their IT spending in 2015 would be up by 5%, and 19.4% said it would grow by 10%, while 7.8% said it would increase 15%.

There was more of the projected 10% and 15% growth in the independent RIA market than in others surveyed. It is not clear to us whether this is because RIAs shoulder a larger technology spending burden than others, or because they are responding faster to changes in the technology landscape.

SOCIAL MEDIA

If there was any doubt that there is a generation gap between older and younger advisors, the social media statistics should put them to rest. Looking at the overall figures, the most popular answer to the question of, “How often do you use social media for business purposes?” was “Never,” at 27.9%.

The next-most-popular answer was once a week (23%). Among our older advisors (ages 55 to 64), 47.6% never use social media. That’s in stark contrast to the 19.6% of our 25- to 34- year-olds who never use it. Our small sample of advisors aged 24 and under gives us a glimpse into the future of the profession; 100% of these youngsters use social media, and over 50% of them use it multiple times a day. Granted, there may be reasons other than age that drive this behavior.

These advisors may view social media as the least costly method of gaining name recognition and PR. They may be targeting a younger demographic who is more active on social media. Whatever the case, it seems likely that social media will become an even more popular form of communication for advisors as the older generation retires and younger folks join the profession.

WHAT ELSE

When we asked advisors what their next technology purchase was likely to be, 29.5% said new computers. This should come as no surprise. When we surveyed advisors last year, 56% were still using Windows 7 computers, 12.4% were using Windows XP and 4.7% were using Windows VISTA. The latter two are obsolete by any measure, and Windows 7 soon will be.

Most advisors refused to move to Windows 8 due to real or perceived weaknesses in the OS. Windows 10 has received a much warmer welcome from the technology community.

Improved security, new functionality, touch screens and the latest generation of hardware all suggest that this is an excellent time for advisors to retire those old Windows computers in favor of the latest models.

COMING ATTRACTIONS

So where do we go from here?

As the old guard retires and more young advisors enter the business, we expect the use of technology to expand, and overall advisor efficiency to rise. We also expect there to be winners and losers among the current crop of providers.

We believe that digital platforms, both advisor-assisted and direct-to-consumer, will continue to proliferate. The use of client portals will also continue to grow. Consumer-facing platforms offering this feature have raised client expectations. Younger investors in particular want this feature, but plenty of baby boomers want it as well.

As investment management continues to be commoditized, we expect the advisor community to continue to emphasize financial planning, as no one has yet developed a technology that can replace the crucial human element.

Having said that, some firms, including MoneyGuidePro, are now introducing new products that provide a self-service way for the public to engage with a basic financial product (however, this new product, MyMoneyGuide, is currently only available to the public through a financial intermediary).

The good news is that any advisor reading this can become an eadvisor with a modest investment in technology tools and training. Those who do are poised to prosper, those who don’t may face some challenging times ahead.