In this world of low bond yields and crazy valuations in stocks, trying to show your value in the world of investments is tough. To create loyal clients, advisers must step up their offering with comprehensive planning based on client goals. One component that typically provides a great wow factor is deep dive tax planning.

When I discuss tax planning with other advisers, they think about techniques such as capital loss harvesting or back door Roth conversions. This is only a small part of what you can offer to provide potentially much greater return.

I love checklists and subscribe wholeheartedly to Dr. Atul Gawande’s methods from his book, “The Checklist Manifesto.”

With tax planning, checklists are key in minimizing mistakes. Our checklist for tax planning covers gathering clients’ tax returns, IRA and Roth contributions, Form 8606 tracking, IRA distributions, 401(k) and other retirement plan contributions, charitable gift planning, tax loss or gain maneuvers, tax bunching, fee deductions, safe harbor tax payments, tax credit planning and communication with a client’s accountant.

We do not prepare tax returns — we feel an accountant’s eyes on the return provides better checks and balances to make certain everything is done correctly.

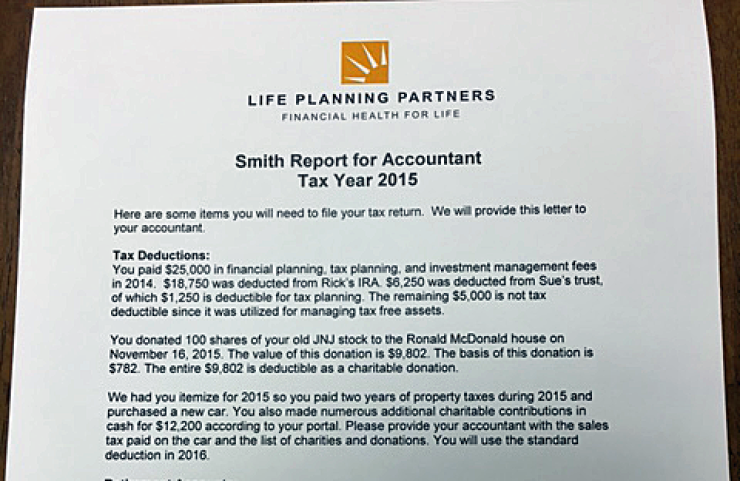

In January, we prepare letters that go out to clients’ accountants directly. Everything that we know happened from a tax perspective is included in the letter — retirement plan contributions and distributions, basis information for IRA contributions, Roth conversions, charitable contributions from IRA accounts or stock donations and the tax deductibility of our fees. Additionally, we let accountants know how many 1099s they should receive from a client so no accounts are overlooked accidentally. We’ve found that accountants love our summaries.

It hurts my heart to see someone with big deductions result in zero taxable income.

When we sign on a new client, we prepare letters of authorization to communicate directly with their accountants, attorneys and insurance agents. This allows us to develop a collaborative team with their specialists.

Tax return reviews start mid-summer in which we check for variances in the data. There are occasional discrepancies, with the two most common errors being missed deductions and failure to update Form 8606 tracking IRA basis.

MAXIMIZING TAX SITUATIONS

Year-round, we track all tax events initiated by us on a master spreadsheet. Intensive projections are done for clients with large deductions or losses from the sale of rental property or a business. It hurts my heart to see someone with big deductions result in zero taxable income. The benefit of their deductions is lost, along with an opportunity to do a Roth conversion or take a low tax distribution from their IRA.

-

Eligible taxpayers can now qualify for a waiver of the 60-day time limit and avoid possible taxes and penalties on early distributions, if they meet certain requirements.

August 25 -

Either a Clinton or Trump presidency could potentially bring changes in estate tax laws, so start preparing now.

August 29 -

Knowing how and when to withdraw can save clients big in their golden years.

August 9

We plan for upcoming cash flow needs among retired clients by determining in advance how much of their spending will be funded by taxable accounts and tax-deferred accounts. Distributions are planned to maximize lower tax brackets and make certain to avoid increasing modified adjusted gross income that would trigger additional Medicare B and Medicare D premiums.

For clients who have retired early but are not yet on Medicare, income is minimized to qualify them for the maximum tax credit provided by buying health insurance through the Affordable Care Act. This can save the client thousands of dollars (and makes them very happy!).For clients with charitable inclinations, we review their taxable portfolios to see if stock donations make sense. If a client is older than 70 ½, we facilitate a donation to charity through IRA accounts and track required minimum distributions.

For clients taking sabbatical years who have no income, it may be a great time to take capital gains and sell enough to keep them in the 15% tax bracket so they pay zero capital gains tax.

Tax projections are run to determine federal tax withholding on IRA distributions so clients don’t have to worry about estimated tax payments, large tax bills or penalties for underpayment of taxes.

The majority of our clients are in Florida; since there is no state income tax, many clients do not benefit from itemizing charitable contributions, real estate taxes or our fees if they itemize annually. For these clients, we help them “tax bunch” and remind them to make large charitable contributions and pay their real estate taxes for two years in the year they itemize.

At the end of the year, we review capital gains and determine if sales should be considered to create losses. For clients taking sabbatical years who have no income, it may be a great time to take capital gains and sell enough to keep them in the 15% tax bracket so they pay zero capital gains tax. We gleefully share the news of what they have saved in taxes.

Our firm is paid on retainer, and our intensive tax planning is one of the values our clients receive. It would be great if the money saved on taxes translated to the internal rate of return on their portfolio statements. Since it doesn’t, we make a point of informing clients of the details of their tax planning. They receive another reminder biannually when we send our fee update letter in which we list services delivered in the previous two years.

Intensive tax planning may sound like a lot of work. The right processes make it less painful and provide a big bang for the buck in client satisfaction and retention. In the face of robo advisers and investment management fee compression, this is a service that keeps clients coming back — and has accountants sending prospects to your door.