When it comes to Medicare premiums, all is not equal for all clients.

In 2017, the standard premium for Medicare Part B is $134 a month. Most enrollees pay for Part B via reductions in their Social Security benefits, and the overall average monthly fee is $109.

Yet some seniors pay almost quadruple that much — $428.60 a month ($957.20 for married couples) — for the exact same medical insurance. That may displease even affluent clients.

Seniors who pay more for Part B also pay Medicare as much as $76 per month extra for prescription drug coverage, known as Part D.

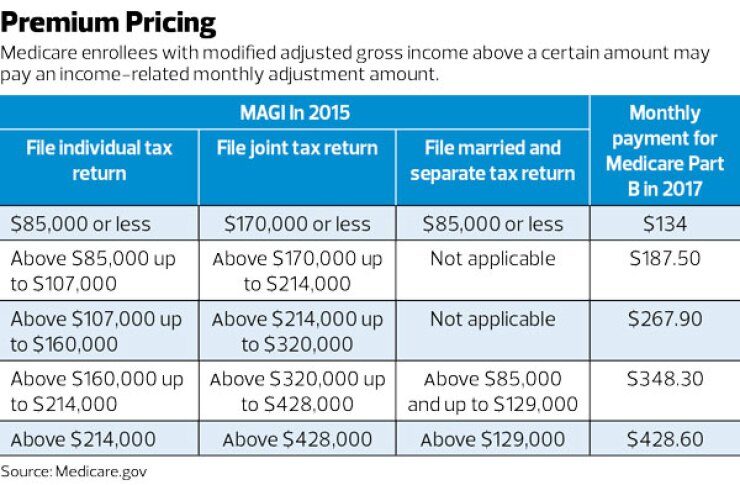

“This is the IRMAA,” the income-related monthly adjustment amount, says Craig Carnick, founder and president of Carnick & Kubik, a Colorado Springs, Colorado, advisory firm. “If people are on Medicare, and their tax return shows high income, Medicare adds the IRMAA amount to their monthly premium.” Modified adjusted gross income over $85,000 ($170,000 on joint returns) brings IRMAA into play, with amounts increasing as MAGI hits certain thresholds. (Here, MAGI includes tax-exempt interest income.)

Those MAGI thresholds won’t increase with inflation until 2020, so more clients may meet IRMAA in the next few years. The Medicare trustees’ 2016 report projects that Part B monthly premiums, which have risen from a maximum of $161.40 in 2007 to $428.60 today, will continue to climb, reaching as much as $564 in 2025. Thus, Medicare Part B is likely to become more of a financial planning issue.

THE TWO-YEAR HITCH

How can planners make Part B less of a bother for high-income clients? One key is to realize that there is a two-year lag between the income observed by Medicare and the resulting payments. Money that flows into a Medicare enrollee’s pocket in 2017 will be reported on a tax return filed in 2018, which determines Part B premiums due in 2019.

“When seniors retire, they may pay the higher premium for two more years until that income history drops off their records,” Carnick says. “In order to reduce Part B premiums sooner than two years, advisers should have such clients appeal their higher IRMAA premium immediately upon retirement, if their income has dropped dramatically. One of the things that could qualify Medicare recipients for an IRMAA reduction is that they have stopped working.”

A key to making Part B less of a bother to clients is to realize that there is a two-year lag between the high income observed by Medicare and the resulting payments.

Kathy Stepp, principal at Stepp & Rothwell, a financial planning and investment advisory firm in Overland Park, Kansas, recalls two clients who appealed their increases and won. “In both cases,” she says, “they qualified for the appeal under the life-changing event of ‘work stoppage.’ One called the Social Security Administration and the other visited in person, to present evidence of retirement. Their Medicare premiums were recalculated.”

Also listed by the federal government as acceptable reasons for Part B relief are marriage, divorce, annulment, death of a spouse, work reduction, loss of income-producing property, loss of pension income, and an employer settlement payment. Advisers can get the necessary form from Social Security:

The list on the form excludes other reasons that could bump up two-year-ago income. “It is not uncommon,” Stepp says, “for a client to have an outlier year of high income, due to stock option exercises or a sale of a capital asset, for example. Then the higher Medicare premium is just another cost, or ‘tax,’ of having that higher income, and we must be prepared for it.” A million-dollar profit on a real estate sale could trigger thousands of extra dollars in Part B premiums two years hence, in addition to other taxes generated by the deal.

WHEN IRMAA PERSISTS

For other Medicare enrollees, a high MAGI is not a one-time occurrence. “When clients regularly have substantial incomes, it’s IRMAA forever,” Carnick says.

Then, Part B planning can become part of ongoing tax planning. “We try to avoid triggering taxable income when it becomes an issue,” Stepp says, “for Medicare premium reasons as well as for all of the other reasons that might be relevant: the 3.8% surtax on net investment income, the safe harbor threshold for estimated taxes, reduction of itemized deductions and so on.”

Planner Diahann Lassus concurs that she pays attention to clients’ Medicare Part B premiums and the MAGI level that drives the calculation.

“We have found that one of the most effective ways of managing these costs is by transitioning dollars from regular IRAs to Roth IRAs,” says the president and co-founder of Lassus Wherley, a wealth management firm in New Providence, New Jersey, and Bonita Springs, Florida. “This sometimes temporarily increases the cost, but if we can reduce the IRA required minimum distributions over the longer term, it makes sense.

One effective way of managing Medicare costs is by transitioning dollars from regular IRAs to Roth IRAs before the client reaches age 70½.

“We have clients who have been converting small amounts every year for several years to gradually reduce those RMDs, and ultimately those costs, such as Part B premiums, that are based on income,” Wherley adds.

If clients’ traditional IRAs are smaller when they reach age 70½ and RMDs kick in, reduced withdrawals can hold down MAGI and the resulting Part B obligation.

Lassus also monitors year-end distributions to determine if it makes sense to move out of an investment fund before the distribution. “We review on a per client basis any fund that is expected to make a large distribution,” she says, “specifically a fund that distributes short-term gains. Our decision is based on what creates the lowest tax liability for the client: the realized gains from selling the fund versus the estimated gains distribution if we continue to hold it. Sometimes there is a significant difference in the tax liability between the two options.”

-

As they reach retirement, clients particularly need help in this area. Get yourself situated to help them.

March 21 -

Advisors can help clients avoid overpaying on taxes by reversing Roth IRA conversions when portfolios fall.

January 4 -

Some investments work best in a taxable account, while others fit well into an IRA or a 401(k).

October 29

Trading costs also must be considered, Lassus adds, as well as a post-sale strategy. After a capital loss, advisers can buy an asset that’s not substantially identical or remain in cash for 30 days, to realize the tax benefit. “If we sell a fund at a loss to avoid a distribution, we might move to an ETF with a similar makeup,” she says. “If there is a gain, the dollars can be reinvested immediately following the distribution.”

BUNCHING DEDUCTIONS

According to Stepp, tactics used by her firm include bunching itemized deductions in order to increase them every other year. “This works when a client’s itemized deductions are just below the standard deduction amount,” she says. “Then the client ends up alternating years between using the standard deduction and itemizing.”

Similarly, Stepp mentions straddling year-ends. “Where we can, we determine in which year to realize income or deductions when we approach the end of a year,” she says. “We analyze the effects of the different timing and how taxes and the Medicare premium change.” Choosing December or January for a taxable event can result in reduced income some years, and perhaps lower Part B premiums.

“In order to keep Medicare premiums down,” Stepp concludes, “we must keep taxable income down.”

As Lassus puts it, “The important part is to understand what drives the premium calculation and to pay attention to income streams where the adviser and/or the client may have some level of control.”