It’s a New Year’s resolution every adviser should make. Heading into 2017, planners should get a handle on which tech developments will help set them up for an increasingly competitive future when it comes to attracting clients — and talent.

Advisers should also heed the newer tech topics becoming increasingly important, such as the risk of cyberattacks, which was a focus of FP’s Tech Survey for the first time.

Which upgrades are attracting clients and yielding real results for firms? Find the answers in the results from FP's annual Tech Survey.

A close examination of the survey data reveals other interesting trends, including which broker-dealers, custodians and third-party tech providers seem to be the best at meeting advisers’ needs, where advisers can get a good return on tech investment and how the next generation of advisers approaches tech.

THE IMPORTANCE OF CRM

For at least a decade now, most practice management and tech experts have said that it’s impossible to run a highly efficient, scalable practice without employing good customer relationship management software.

CRM often serves as the hub of the whole advisory practice. It’s the central repository of all client information, as well as adviser tasks. It can also automate workflows, which improves speed and efficiency.

If CRM software is configured properly, it can provide business intelligence that can further enhance productivity and profitability.

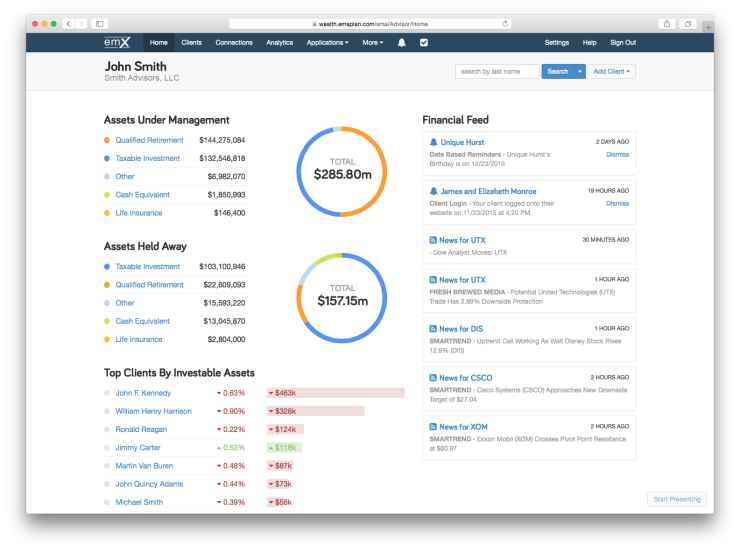

For example, many CRM products serving the adviser market now offer business-intelligence dashboards. These dashboards display vital business metrics that can include AUM by adviser, revenue per client, profitability by adviser and client, average age of client base over time and workflows in progress. The Department of Labor fiduciary rule, if implemented, will strengthen the case for CRM usage. But given Donald Trump’s election, implementation of the rule is now uncertain.

If the rule isn’t shelved, CRM software can play a vital role in the process. Much of what is discovered about a client’s financial situation can be captured and stored in a CRM system. Through the use of CRM workflows, advisers can document the entire process that led to a recommendation. CRM can also note which disclosure documents were provided to clients, and when they were made.

A cursory examination of the Tech Survey data might lead one to believe CRM adoption has been static the past few years. The data indicates that 12% of advisers in 2012 said they did not use CRM, versus 12.5% of the 500+ advisers polled in this year’s survey. But a closer look is quite enlightening.

In 2012, 32% of respondents said they use MS Outlook for CRM, compared with less than 16% this year. Because MS Outlook is not CRM (it does not have the necessary data fields, workflows or other attributes of true CRM), and the “none” responses were essentially constant, it’s clear that a significant number of firms have adopted true CRM over the past several years.

It’s also clear that advisers are abandoning a number of CRM products that once had a substantial following. For example, in 2013, ACT commanded a 9% market share. Usage in 2016 fell to 3.3%. Goldmine, which had a 2% share in 2012, has all but disappeared.

Redtail is the clear leader, with a 21.6% market share. Its lead is even more commanding in the independent broker-dealer segment. Usage is consistent across all age groups, a good indication of business strength. It’s also consistent across all asset levels up to about $500 million in AUM.

SURVEY POPULATION

Redtail has been a regular leader in the field for many years now. We believe there are a number of reasons for this. Notably, the price is highly competitive. It retails for $99, but many firms and organizations offer discounts. The license covers up to 15 users, so for firms with more than one or two users, the price is hard to beat.

If there is one soft spot in Redtail’s dominance, it’s at the highest AUM level. It seems that, once firms attain that position, they are twice as likely to prefer Salesforce, the runner-up in the category.

Salesforce does particularly well in the employee of a broker-dealer and bank-affiliated categories. This indicates Salesforce is strong in the segment of the enterprise market, where centralized decision-making drives buying decisions.

-

A firm’s presence must be relevant and robust.

July 21 -

Embracing technology is no longer an option. Here’s how David Root of D.B. Root & Co. uses it to build his brand and finds prospects.

September 7 -

How can firms adapt to automation without eroding their business or need for advisers?

September 22

We’re not quite sure what to make of a relative newcomer, Wealthbox CRM. It shows up with a 3.3% share, virtually all of it in the independent RIA space. The vast majority of Wealthbox users report AUM of under $10 million. If these firms are able to grow their asset base, and if Wealthbox can retain them as clients, this could be viewed as a positive.

However, if these firms can’t generate growth, or if Wealthbox cannot attract higher-AUM advisory firms, it may be challenged.

PLANNING SOFTWARE

There are a number of reasons the financial planning software category is worthy of close scrutiny next year, but two stand out.

First, many industry observers think investment management is becoming commoditized. Few advisers believe they add investment alpha after taxes and expenses, so tying their continued employment to investment performance is probably not a good idea. That being the case, a greater emphasis on planning was predictable.

Second, if advisers are touting themselves as fiduciaries under the DoL rule, they need to know more about clients than was required under the old suitability standard for registered reps.

Even independent RIAs, who have long operated as fiduciaries, will probably need to do more discovering, documentation and disclosure with regard to IRA rollover recommendations from a qualified plan.

In the recently published book “Exploring Advice,” Kevin Knull and a number of contributors argue that financial planning software is necessary to provide quality advice.

Yet in our survey, almost 24% of respondents said that they did not use it. We expect this number to decrease substantially over the next two years among those offering fiduciary advice to retirement account holders.

For those advisers who do use planning software, the field is increasingly looking like a two-horse race between MoneyGuidePro, the leader each year since 2008, and eMoney, which has consistently ranked second the past several years.

MoneyGuide Pro has built its reputation by providing highly sophisticated, goal-based planning software. Earlier this year, it greatly simplified the data-entry process and built workflows into the application. It also released Best Interest Scout, a workflow tool designed to help firms comply with the fiduciary rule.

MoneyGuidePro exhibits strength across all ages and AUM categories, in particular among advisers aged 25 to 34.

EMoney is known for its cash-flow-based planning, account aggregation and a highly popular client portal. Its purchase by Fidelity has led to an increased investment in technology, as well as deep integration with the Fidelity adviser platform.

EMoney has announced it will be incorporating compliance tools to help advisers comply with the fiduciary rule. As is the case with MoneyGuidePro, eMoney exhibits strong numbers among those 25 to 34.

-

The second wirehouse deal for the digital advice startup comes after announcing a blockbuster partnership with UBS.

November 15 -

The firm's digital advice service, to be piloted in early 2017, is a bid to give RIAs unprecedented scale.

October 18

The third-ranked firm, Advicent, has been a bit slower to respond to the fiduciary rule, but CEO Phil Cunningham says the company is taking a deliberate approach to this and other industry trends.

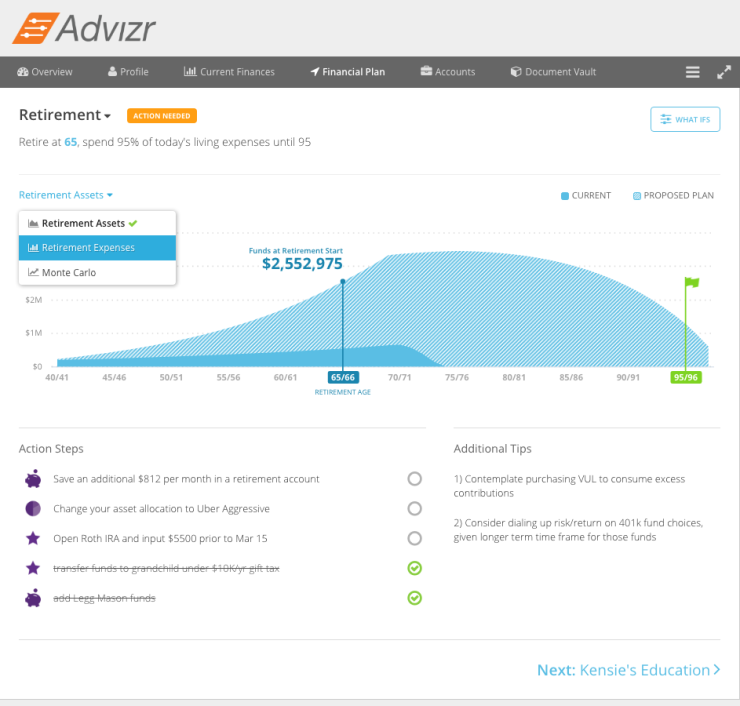

A couple of relative newcomers are also making their presence felt. Both Advizr and RightCapital appear to be targeting primarily younger advisers and clients. Advizr, which premiered in last year’s survey, scored a 2.8% share among those who use planning software, up from 1.7% last year.

Right Capital makes its debut this year at 2%. What’s noteworthy is that, among the survey’s respondents, Advizr advisers were almost twice as likely as Right Capital advisers to have AUM under $10 million. We will watch to see if that trend continues.

CYBERSECURITY

Cybersecurity is another hot topic in regulatory and technology circles.

This year, we asked advisers for the first time whether they had experienced a cyberattack.

Of those who responded, 2.9% overall admitted that a successful attack had been launched against them or their firm. The data indicate that bank-affiliated advisers were more likely to be attacked successfully, as were advisers age 65 or older.

These numbers are not surprising. Banks have been the target of some well-publicized, sophisticated attacks, and older advisers, as a group, are not technology natives, so they tend to be somewhat less tech savvy than their younger colleagues.

Just over 11% of advisers said they had been the subject of an unsuccessful attack.

In all, more than 14% of advisers were the subject of an attack this past year. If nothing else, the data indicates a need for constant vigilance and additional investment in equipment, as well as mandated employee and client training.

Why client training? Many advisers we spoke with indicated that an attack on their firm originated with a hack of a client. The hacker then used that information to attack the firm.

About 86% of advisers told us they were “not aware of” any hacker attacks this past year. Yet just because an adviser is not aware of an attack or attempted attack doesn’t mean it didn’t happen.

RISK-ASSESSMENT SOFTWARE

One of the fast-growing software categories the past two years has been third-party risk assessment software.

As recently as two years ago, 49% of advisers said they didn’t use this kind of software, and another 29% used a tool supplied by their broker-dealer or custodian.

This year, only 46% answered that they used none, and 25% used a BD or custodian-supplied tool. The “other” answer declined to 4% from 9%.

Every firm's focus is on capturing a share of the predicted $7 trillion market by 2020.

It appears that, overall, much of the growth is attributable to the rise of Riskalyze. Its overall market share rose to 15.6% this year from 6.8% in 2014. Riskalyze is strong across all channels, whereas FinaMetrica competes most closely in the independent RIA space.

Riskalyze also displays very strong appeal to younger advisers. In the 25-to-34 age group, Riskalyze dominates with a 44% share versus 8% for FinaMetrica.

Clearly, many broker-dealers and other enterprise buyers are concluding that outsourcing this software to a specialist is better that developing it in-house.

As with many other technology segments, the fiduciary rule may ultimately act as a catalyst to accelerate the trend.

PORTFOLIO MANAGEMENT

We believe the portfolio management software category is primed for disruption, and we may already be seeing signs of it.

Our working theory is this: Most advisory firms, particularly independent RIAs, spend the greatest percentage of their tech budgets on investment-related software, with portfolio management and accounting contributing significantly to overall cost in many cases.

If one believes that investment advice is being commoditized and that most advisers don’t add investment alpha after expenses and taxes, is the heavy spending on technology-related software in general — and portfolio management software in particular — sustainable?

In addition, both Fidelity and Schwab are developing their own portfolio management and accounting systems for advisers, and it’s likely other major custodians may follow suit. All of this should put downward pressure on prices.

Most advisory firms, particularly independent RIAs, spend the greatest percentage of their tech budgets on investment-related software, with portfolio management and accounting contributing significantly to overall cost in many cases.

Of course, many providers of portfolio management software are expanding their reach to combat this trend.

Envestnet’ s Tamarac Adviser Xi offers an integrated suite of products that includes CRM, portfolio management and reporting, a client portal and rebalancing.

Envestnet’s acquisition of Finance-Logix and a robo adviser platform will allow Tamarac to further broaden its offering.

In Black Diamond’s case, it appears to be pivoting from a strictly portfolio management and accounting solution to more of a platform/integration play.

Orion has long been an advocate of integration, and it, too, can be considered more of a platform play these days.

As the Schwab and Fidelity products roll out over the next 24 months, it will be interesting to see what, if any, impact that they have on some of the industry’s more traditional participants.

Morningstar, the overall leader in this category, offers a relatively low-cost option when compared with some of the more sophisticated products on the market, but it’s not right for everyone.

ROBO ADVISERs/DIGITAL

This wouldn’t be a Tech Survey story, of course, without some mention of the available and upcoming digital advice platforms for advisers. This segment, too, is evolving rapidly.

One thing is clear: There is still a great deal of confusion about digital advice platforms.

When we asked advisers what robo adviser they use, Betterment was the top answer, followed by Schwab. And when we asked them what digital advice platform they use, Schwab was the top answer, followed by Betterment and Autopilot.

Only about 19% of advisers are currently using a digital advice platform, but we expect that this number will grow significantly over the next 24 months.

One thing is clear: There is still a great deal of confusion about digital advice platforms.

We also expect the category to evolve. Fidelity recently announced its AMP digital advice platform for advisers. Co-developed with eMoney, this is the first platform to offer a goal-focused experience, as opposed to an investment-focused one.

In addition, Vestmark recently announced its digital advice platform. What distinguishes the Vestmark platform is that the stable of investment options goes well beyond the typical ETF listings.

Advisers using Vestmark can use a unified management account as the investment platform, allowing for the use of equities, SMAs and the like, in addition to mutual funds and ETFs. We expect further innovation in the digital advice space in 2017.

KEY TAKEAWAYS

Clearly, advisers need to stay up to date on the fiduciary rule, cybersecurity, financial planning software, CRM, portfolio management software, digital advice platforms and the relative technology merits of custodians and broker-dealers.

The good news for advisers is that there is a great deal of investment being made in technology to serve them and their clients.

The bad news, as indicated by the dispersion of satisfaction in the BD and custodial space, is that it is highly important to stay abreast of developments and conduct the necessary due diligence.

Research by my firm, Technology Tools for Today, indicates that the vast majority of firms do not have the proper infrastructure in place to monitor and act upon technology changes.

This year’s survey confirms our findings. Only 32% of firms evaluate technology at least annually, and 35% have no set schedule for evaluating technology.

If there is a silver lining in these dismal numbers, it’s this: The tech decision-makers at firms are starting to skew younger: 15.4% of firms say their tech decision maker is 25 to 34, while an additional 24.5% say their decision maker is 35 to 44.

We’ll be tracking this metric next year to see if a pattern is developing. Bigger picture, the industry is dealing with some significant challenges, but tools are available that can help advisers grow and prosper.