The Modern Wealthy Family: What Advisors Are Getting Wrong

The modern family comes in many different shapes and sizes, but there is a disconnect in the way advisors approach planning for them, according to a recent UBS Investor Survey titled Beyond the Picket Fence: Financial challenges of the modern American family.

A number of contemporary family issues an advisor might find themselves counseling clients through include the costs of divorce, children from multiple marriages, inheritance claims and very recently, legalized same sex marriage.

It's important to identify the specific set of challenges advisors can face when dealing with a variety of clients, UBS says.

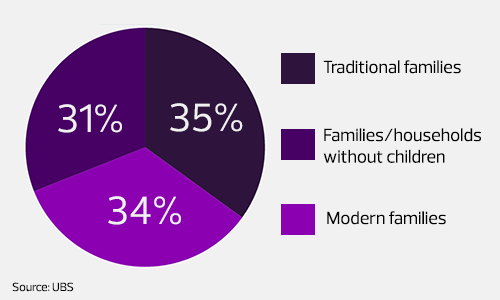

"The main takeaway from my perspective is that advisors should be cognizant that many of their clients are not fitting into the definition of what we think of as a traditional family," says Ann Bjerke, senior wealth strategist at UBS' advanced planning group. "Especially among wealthy families, modern families are almost as common as traditional families."

Click through to see the study's findings along with some best practice tips for advisors, or see the one-page version here. -- Maddy Perkins

How would you categorize your client's family?

"When advisors are approaching all clients they should be determining what the family situation is of each client," says Bjerke. "Tailoring their advice to make sure they're addressing all of the concerns and complications that might be arising as a result of the client's specific family situation may be different than what we traditionally think of."

Modern families are almost as common as traditional families

Financial services aren't keeping up with modern families

"The concern is that financial advisors are using a one-size-fits-all approach to how they advise families," says Bjerke. "They should be cognizant of the fact that these families and their clients are not fitting this traditional mold."

Blended families tend to have more complicated financial lives

Same-sex couples need different advice

"Understanding the relationship that same sex couples have is critical, whether they've previously entered into a domestic partnership or whether they are married," she says. "If they're married, now they're treated under federal law and state law exactly the same as the hetero sexual couple. This makes it easier for planning for retirement planning, estate planning, income tax planning etc."

Bjerke adds it's also important to check and see if your client has been working with a tax advisor to get a look at the way they have been approaching income taxes specifically in previous years.