10 Biggest High-Yield Bond Funds

Of course, many advisors are concerned that investors consider them as safe as other fixed-income securities while they can be far more volatile than Treasuries and in fact, incur substantial losses.

High-yield defies broad description because it covers a wide range of industries and various levels of risk (BB is quite different than CCC). But as a market, high-yield returned about 2.4% overall in 2014, according to the BofA Merrill Lynch U.S. High Yield Master II Index. That's lower than its historical norm of about 5%.

In an illustration of just how risky this market can be, returns fell and then climbed so drastically in December that investors could have made almost all of that annual profit (2.1%) in just the last two weeks of the year. Moreover, this move came in the midst of headline-grabbing cash outflows. The six-month bleed was partly attributable to worries over the drop in oil prices, since energy companies make up a sizable portion of this market. Investors reportedly pulled $523 million out of the market in just one week (ending Jan. 21) last month. -- Lee Conrad with reporting from Andrew Pavia

For clients who are willing to take on a bit more risk, here we present the 10 largest high-yield funds, along with performance metrics for each.

Click through or view a single-page version here.

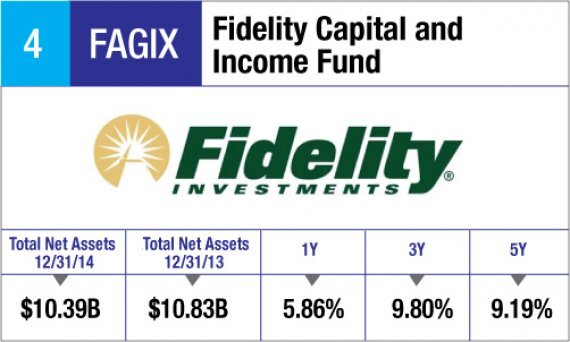

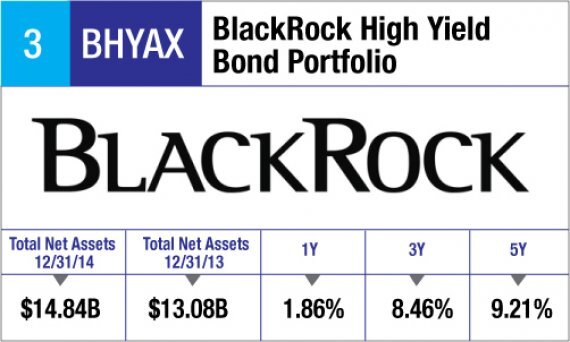

Data is from Morningstar as of Jan 26.

10. MainStay High Yield Corporate Bond Fund

9. Ivy High Income Fund

8. Lord Abbett Bond Debenture Fund

7. T. Rowe Price High Yield Fund

6. JPMorgan High Yield Fund

5. PIMCO High Yield

4. Fidelity® Capital and Income Fund

3. BlackRock High Yield Bond Portfolio

2. Vanguard High Yield Corporate Fund